Include fresh produce, baby essentials under SARA aid, says group

- Details

The Kuala Lumpur and Selangor Women and Single Mothers Association says this will support child development.

The Kuala Lumpur and Selangor Women and Single Mothers Association says this will support child development.

Kuala Lumpur and Selangor Women and Single Mothers Association president Sheilla Tukimin suggested that beneficiaries of the initiative be allowed to redeem items such as diapers, fish, chicken, and vegetables to meet their daily needs.

Sheilla said the proposal was aimed at supporting children’s growth, focusing on hygiene care, and encouraging healthy eating habits.

“It would be better if the government expanded the range of items that can be redeemed as each family has different needs,” she said.

“If possible, fresh produce should also be allowed as many families in the B40 and M40 groups cook at home. I urge the government to consider this.”

The SARA programme allows recipients to use their MyKads for the purchase of essential items at participating supermarkets and retail stores nationwide.

Read more: Include fresh produce, baby essentials under SARA aid, says group

'BNM perlu larang bank promosi insurans dalam premis, elak perdaya pelanggan' - CAP

- Details

GEORGETOWN: Persatuan Pengguna Pulau Pinang (CAP) menggesa Bank Negara Malaysia (BNM) melarang institusi kewangan daripada mempromosikan sebarang bentuk insurans, terutama berkaitan pelaburan di dalam premis mereka.

GEORGETOWN: Persatuan Pengguna Pulau Pinang (CAP) menggesa Bank Negara Malaysia (BNM) melarang institusi kewangan daripada mempromosikan sebarang bentuk insurans, terutama berkaitan pelaburan di dalam premis mereka.

Presidennya, Mohideen Abdul Kader berkata, CAP menerima aduan ada pegawai bank mendekati pelanggan dalam premis bank bagi mempromosikan insurans berkaitan pelaburan sebagai 'pilihan pelaburan yang lebih baik dengan pulangan lebih tinggi berbanding simpanan atau deposit tetap'.

Katanya, dalam kebanyakan kes, pelanggan tidak dimaklumkan mereka sedang ditawarkan insurans berkaitan pelaburan yang memerlukan pembayaran premium dalam tempoh beberapa tahun.

"Dalam satu kes, seorang wanita mendakwa dia sudah memberitahu pegawai bank bahawa dia enggan membeli sebarang insurans kerana hampir bersara dan mempunyai simpanan terhad.

"Pegawai bank itu meyakinkannya bahawa ia hanyalah 'Pelan Simpanan' yang dikunci selama lima tahun dan kerana menyangka ia produk deposit tetap yang baharu, wanita itu bersetuju sebelum diberi satu timbunan dokumen dengan cetakan halus bagi ditandatangani.

Read more: 'BNM perlu larang bank promosi insurans dalam premis, elak perdaya pelanggan' - CAP

‘US tariffs may cause price surge for everyday goods’

- Details

Ripple effects will be felt as businesses adjust to declining revenue and rising costs: Consumers association

Ripple effects will be felt as businesses adjust to declining revenue and rising costs: Consumers association

PETALING JAYA: Malaysian consumers may face price increases on everyday goods as a result of the new 24% US tariff on Malaysian exports, warned Federation of Malaysian Consumers Associations (Fomca).

Its CEO and secretary-general Dr Saravanan Thambirajah said while the tariff directly impacts exports, its ripple effects would be felt by local consumers as businesses adjust to declining revenue and rising costs.

“Exporters struggling to compete in the US market may try to shift excess stock or production costs to the domestic market.

“Logistics expenses could rise due to decreased export volumes or rerouted trade routes, further driving up prices.”

The products most affected would be those tied to export-driven industries, including electronics, palm oil-based products, rubber goods and processed foods.

For instance, items such as televisions, laptops, washing machines, cooking oil, soaps, medical gloves, tyres and food products relying on imported ingredients may see price hikes.

Read more: ‘US tariffs may cause price surge for everyday goods’

Fine-tune medical devices

- Details

PETALING JAYA: Medical devices such as blood pressure monitors are designed for clinical use and typically require regular calibration as recommended by the manufacturers, says the Malaysian Pharmacists Society (MPS).

PETALING JAYA: Medical devices such as blood pressure monitors are designed for clinical use and typically require regular calibration as recommended by the manufacturers, says the Malaysian Pharmacists Society (MPS).

This was in reference to complaints of inaccurate readings by some devices including unauthorised ones being sold online.

“There have been documented cases where inaccurate readings led to inappropriate health decisions, especially in the management of chronic conditions like heart disease or diabetes, where readings directly impact treatment,” said MPS president Prof Amrahi Buang.

In some instances, he said, wearable devices have even been reported to interfere with implanted devices such as pacemakers.

“While these incidents are not widespread, they highlight the importance of accuracy, certification and user education when using health monitoring gadgets,” he said when contacted.

As for devices that are sold online, he said these gadgets are relatively safe provided that they are certified by the Malaysian health authorities.

“It can be safe if consumers are careful. All medical devices in Malaysia must be registered with the Medical Device Authority (MDA), so consumers should look for certification.

ஏஐ வேலை வாய்ப்பு முறையானதா?

- Details

பெட்டாலிங் ஜெயா மார்ச் 5: செயற்கை நுண்ணறிவு (ஏஐ) புற அலுவல் நிறுவனங்கள் வெளியிட்டு வரும் விளம்பரங்களால் உலக அளவில் ஆயிரக்கணக்கான முறை சாரா தொழிலாளர்கள் பாதிக்கப்பட்டு வருவதாக தேசிய பயனீட்டாளர் புகார் மையம் (என்சிசிசி) கூறியது. குறிப்பாக மலேசியாவில் இந்த ஏஐ புற அலுவல் நிறுவனங்களுக்கு எதிராக புகார்கள் அதிகரித்து வருவதாக என்சிசிசி மூத்த நிர்வாகி சாரால் ஜேம்ஸ் மணியம் கூறினார்.

பெட்டாலிங் ஜெயா மார்ச் 5: செயற்கை நுண்ணறிவு (ஏஐ) புற அலுவல் நிறுவனங்கள் வெளியிட்டு வரும் விளம்பரங்களால் உலக அளவில் ஆயிரக்கணக்கான முறை சாரா தொழிலாளர்கள் பாதிக்கப்பட்டு வருவதாக தேசிய பயனீட்டாளர் புகார் மையம் (என்சிசிசி) கூறியது. குறிப்பாக மலேசியாவில் இந்த ஏஐ புற அலுவல் நிறுவனங்களுக்கு எதிராக புகார்கள் அதிகரித்து வருவதாக என்சிசிசி மூத்த நிர்வாகி சாரால் ஜேம்ஸ் மணியம் கூறினார்.

இந்த வேலை வாய்ப்பின் வழி வாரத்திற்கு வெ 7,500 சம்பளம் வழங்கப்படும் என இந்த புற அலுவல் நிறுவனங்கள் விளம்பரம் செய்து வருவதாக அவர் சுட்டிக் காட்டினார்.ஆனால் இந்த தகவல் உண்மை அல்ல என இறுதியில் தெரிய வருவதாக அவர் சொன்னார்.ஏஐ மேம்பாட்டுக்கு பங்களிப்பவர்களுக்கு ஒரு மணி நேரத்திற்கு வெ 80 முதல் வெ 180 வரை சம்பளமாக வழங்கப்படும் என மலேசியாவில் ஏஐ புற அலுவலக நிறுவனம் ஒன்று விளம்பரம் செய்து வருகிறது. பயிற்சி தொகுதிகள், பரீட்சைகள் மற்றும் இதர பணிகள் முடித்த பின் இந்த பணியாளர்களுக்கு சம்பளம் வழங்கப்படவில்லை என பலர் புகார் செய்துள்ளனர் என அவர் சுட்டிக் காட்டினார்.

மேலும் அந்த நிறுவனம் இவர்களின் கணக்குகளை ரத்து செய்துள்ளது அல்லது புறக்கணித்துள்ளதாக அவர் குறிப்பிட்டார். இது குறித்து 3,600க்கும் மேற்பட்ட உறுப்பினர்கள் அதிருப்தி மற்றும் சம்பளம் வழங்கப்படாத வேலை குறித்து கருத்து பரிமாற்றம் செய்து கொண்டதாக அவர் தெரிவித்தார். மலேசியாவில் கூடுதல் வருமானத்தை பெற முயற்சிக்கும் பல இது போன்ற நிறுவனங்களிடம் ஏமாந்து போகின்றனர்.

Fomca calls for increased oversight as SARA expands to 5.4 million beneficiaries

- Details

Fomca says retailers and government agencies must collaborate to ensure adequate supply for SARA beneficiaries.

PETALING JAYA: The authorities have been urged to monitor the 3,500 premises involved in the Sumbangan Asas Rahmah (SARA) programme to ensure that the supply of goods is always sufficient and to guarantee the effectiveness of the initiative.

PETALING JAYA: The authorities have been urged to monitor the 3,500 premises involved in the Sumbangan Asas Rahmah (SARA) programme to ensure that the supply of goods is always sufficient and to guarantee the effectiveness of the initiative.

The Federation of Malaysian Consumers Associations (Fomca) said the increased number of SARA beneficiaries – 5.4 million compared to 700,000 previously – should be able to redeem items easily.

The SARA programme allows recipients to use their MyKads for the purchase of essential items at participating supermarkets and retail stores nationwide.

The finance ministry has said that households eligible for the assistance will receive up to RM2,100 each for the entire year, a 75% increase from RM1,200 last year.

Details on the distribution of the Sumbangan Asas Rahmah assitance this year. (Finance ministry)

Fomca CEO T Saravanan said the association welcomed the government’s initiative, which would not only alleviate the cost of living but also increase purchasing power.

However, he said the success of the programme in ensuring that those in need can purchase basic goods required close collaboration between retailers and government agencies.

“A shortage of supply due to increased demand could disrupt the smooth operation of the programme,” he said.

Urging retailers to work with suppliers and the related agencies to ensure the proper management of stock and logistics, Saravanan said that price monitoring should also be enhanced.

Read more: Fomca calls for increased oversight as SARA expands to 5.4 million beneficiaries

Read the label first as product may contain mercury

- Details

PETALING JAYA: Exercise caution when buying skincare and cosmetics, as those containing dangerous ingredients can be a health hazard, say medical experts.

PETALING JAYA: Exercise caution when buying skincare and cosmetics, as those containing dangerous ingredients can be a health hazard, say medical experts.

They cautioned that mercury is a common ingredient found in products flagged by the Health Ministry.

Dr Chin Shih Choon, past president of the Malaysian Society of Aesthetic Medicine, said skincare products containing mercury posed serious health risks due to its toxic effects on the body.

Such products could cause skin and kidney damage, neurological effects, respiratory issues, hormonal disruptions and environmental contamination, he said.

“Pregnant women using mercury-containing products risk passing the toxin to their unborn child, which lead to developmental issues, brain damage and birth defects. Breast-fed infants may also be exposed through contaminated milk,” he said.

Dr Chin said to be safe, one should always choose skincare products that comply with regulatory standards and avoid those containing mercury or its compounds such as mercuric chloride, calomel and mercurous chloride.

“If you suspect mercury exposure, discontinue use immediately and seek medical advice. Consult a dermatologist or aesthetic doctor before using new skincare products, especially if they claim fast whitening or anti-ageing effects.

Read more: Read the label first as product may contain mercury

Drug price display key to lowering medical costs

- Details

PETALING JAYA: The price display of drugs and medical services will help mitigate spiralling medical insurance and medical costs, says the Federation of Malaysian Consumers Associations (Fomca).

PETALING JAYA: The price display of drugs and medical services will help mitigate spiralling medical insurance and medical costs, says the Federation of Malaysian Consumers Associations (Fomca).

Such transparent pricing would empower patients to make informed decisions about their healthcare, encourage healthy market competition and ultimately contributes to lowering overall costs, said Fomca vice-president and legal advisor Datuk Indrani Thuraisingham.

By clearly displaying medication costs separately from consultation fees, she said patients can compare prices and avoid hidden charges.

“When consumers are aware of pricing details, they are better equipped to manage their expenses, particularly in a time when out-of-pocket healthcare costs continue to rise.

“In today’s challenging economic environment, ensuring that every Malaysian has access to affordable and clear healthcare information is not just a policy option but a consumer right.

“Fomca has consistently advocated for stronger government oversight and regulation of private healthcare fees to prevent excessive profiteering and ensure fair pricing where many Malaysians are already struggling with rising cost of living.

Free 5GB data on first day of Raya will help people strengthen ties

- Details

KUALA LUMPUR — The announcement of a 5GB free data incentive for Malaysians on the first day of Hari Raya Aidilfitri is considered a noble effort by the MADANI government to particularly benefit the B40 group who have limited data plans.

KUALA LUMPUR — The announcement of a 5GB free data incentive for Malaysians on the first day of Hari Raya Aidilfitri is considered a noble effort by the MADANI government to particularly benefit the B40 group who have limited data plans.

Federation of Malaysian Consumers Associations (FOMCA) president Datuk Dr. Marimuthu Nadason said that the provision of free data is a positive step, especially during the festive season, to ensure that all layers of society can continue to connect with family and friends without internet access limitations.

“Although this incentive may seem small, it is still significant because communication is essential in daily life. The B40 group will certainly welcome this initiative because it greatly needs assistance in accessing data,” he told Bernama today.

Communications Minister Datuk Fahmi Fadzil, who is also the spokesperson for the MADANI government, today announced the provision of the RAHMAH rebate incentive in the form of an additional minimum data quota of 5GB for prepaid and post-paid users.

The additional data quota is valid for a minimum period of 24 hours, subject to the terms and conditions of the involved telecommunications service provider.

Meanwhile, Malaysian Youth Council (MBM ) chief information officer Syafiq Ridzwan Jamaluddin believes that this incentive also opens up opportunities for the youth to optimise the use of digital technology in various forms, including producing high-quality creative content for the celebration, thereby igniting the spirit of Aidilfitri on digital platforms.

Read more: Free 5GB data on first day of Raya will help people strengthen ties

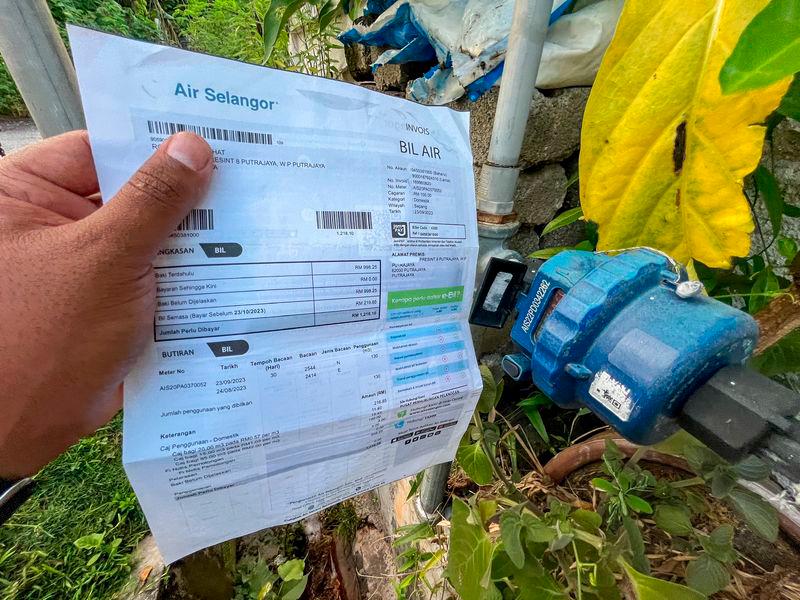

Mixed public response to proposed water tariff hike

- Details

Govt must ensure grouses are heard and address complaints on quality and supply reliability: Fomca

PETALING JAYA: A proposed water tariff review has divided public opinion – while some see it as crucial for better infrastructure, others fear it will worsen the financial burden of struggling households.

PETALING JAYA: A proposed water tariff review has divided public opinion – while some see it as crucial for better infrastructure, others fear it will worsen the financial burden of struggling households.

Engineer Razman Ismail, 48, acknowledged the need for sustainable water management but insists that any increase must be reasonable and justified. “While I’m living quite comfortably, the increase should still be reasonable, perhaps around 5% to 10%. But, authorities must be transparent about how the funds will be used.”

This view aligns with concerns expressed by the Federation of Malaysian Consumers Associations (Fomca), which opposes tariff hikes without clear justification and transparency.

Fomca CEO Dr Saravanan Thambirajah urged the government to ensure consumer voices are heard, adding that it opposed decision-making that treats public consultation as a mere ‘tick-the-box’ exercise.

“The government must address concerns about affordability, service quality and accountability. We also call for audit reports to be made public to ensure water operators manage funds responsibly.”

On March 10, Deputy Prime Minister Datuk Seri Fadillah Yusof said the government was reviewing water tariffs, with adjustments expected in some states.

Read more: Mixed public response to proposed water tariff hike

Page 11 of 111